Win-Loss

Research

Playbook #17: How to Build a Win-Loss Program

Playbook #17: How to Build a Win-Loss Program

Playbook #17: How to Build a Win-Loss Program

Build a win-loss program that drives real change—not just research.

This playbook shows you how to:

Earn cross-functional buy-in

Run buyer-centric win-loss interviews

Turn insights into action and ROI

Build a repeatable, scalable truth engine

Perfect for PMMs who want impact, not anecdotes.

Introduction

Most companies think they understand why they win and lose deals… until they ask their buyers.

There’s no question that buyer-validated truth is more valuable than internal hunches and assumptions. But how do we find and leverage that truth?

That’s the power of a strong win-loss program.

This playbook will show you how to build a win-loss program that doesn’t just collect insights, but drives action, alignment, and change across your company.

You’ll learn how to:

Get buy-in from sales, product, and exec teams

Design interviews that uncover what buyers really think

Turn raw interviews into usable insights

Close the loop so those insights actually change behavior

Most companies think they understand why they win and lose deals… until they ask their buyers.

There’s no question that buyer-validated truth is more valuable than internal hunches and assumptions. But how do we find and leverage that truth?

That’s the power of a strong win-loss program.

This playbook will show you how to build a win-loss program that doesn’t just collect insights, but drives action, alignment, and change across your company.

You’ll learn how to:

Get buy-in from sales, product, and exec teams

Design interviews that uncover what buyers really think

Turn raw interviews into usable insights

Close the loop so those insights actually change behavior

Most companies think they understand why they win and lose deals… until they ask their buyers.

There’s no question that buyer-validated truth is more valuable than internal hunches and assumptions. But how do we find and leverage that truth?

That’s the power of a strong win-loss program.

This playbook will show you how to build a win-loss program that doesn’t just collect insights, but drives action, alignment, and change across your company.

You’ll learn how to:

Get buy-in from sales, product, and exec teams

Design interviews that uncover what buyers really think

Turn raw interviews into usable insights

Close the loop so those insights actually change behavior

Meet the author

Ryan Sorley is the VP of Win-Loss at Klue and one of the go-to experts on win, loss, and churn research programs. He's spent over fifteen years at research heavyweights like Gartner, AMR Research, and Forrester, helping hundreds of B2B companies figure out how buyers actually make decisions. In 2014, he started DoubleCheck Research, a win-loss research firm focused on helping companies uncover what buyers really think and fix the blindspots that slow down growth. DoubleCheck was eventually acquired by Klue, where Ryan and his team now build and run third-party win-loss programs for forward-thinking B2B tech and manufacturing companies. Ryan also wrote BlindSpots: The Ultimate Guide to Building a Better Win-Loss Program and lives outside Boston with his family and his not-so-mini Bernedoodle, Meeko.

Where to find Ryan:

Meet the author

Ryan Sorley is the VP of Win-Loss at Klue and one of the go-to experts on win, loss, and churn research programs. He's spent over fifteen years at research heavyweights like Gartner, AMR Research, and Forrester, helping hundreds of B2B companies figure out how buyers actually make decisions. In 2014, he started DoubleCheck Research, a win-loss research firm focused on helping companies uncover what buyers really think and fix the blindspots that slow down growth. DoubleCheck was eventually acquired by Klue, where Ryan and his team now build and run third-party win-loss programs for forward-thinking B2B tech and manufacturing companies. Ryan also wrote BlindSpots: The Ultimate Guide to Building a Better Win-Loss Program and lives outside Boston with his family and his not-so-mini Bernedoodle, Meeko.

Where to find Ryan:

Meet the author

Ryan Sorley is the VP of Win-Loss at Klue and one of the go-to experts on win, loss, and churn research programs. He's spent over fifteen years at research heavyweights like Gartner, AMR Research, and Forrester, helping hundreds of B2B companies figure out how buyers actually make decisions. In 2014, he started DoubleCheck Research, a win-loss research firm focused on helping companies uncover what buyers really think and fix the blindspots that slow down growth. DoubleCheck was eventually acquired by Klue, where Ryan and his team now build and run third-party win-loss programs for forward-thinking B2B tech and manufacturing companies. Ryan also wrote BlindSpots: The Ultimate Guide to Building a Better Win-Loss Program and lives outside Boston with his family and his not-so-mini Bernedoodle, Meeko.

Where to find Ryan:

Why Win-Loss Matters

When your company loses deals, everyone has an opinion around why. But rarely do those opinions come from the people who actually made the decision: the buyers.

During my time at Gartner, I was advising a CIO who was looking to purchase an ERP platform. One potential vendor (actually his preferred option) kept disappointing him during the sales process. They weren’t responsive, gave surface-level answers to his most important questions, and generally seemed indifferent to winning his business. As a result, he ended up going with the second-place vendor.

The preferred vendor lost a $40mil deal!

And to make matters worse, they never even knew why, because they never followed up to ask.

If they had, they could have learned from their mistakes and made a change to their sales process. Instead, they likely continued to lose millions due to very solvable problems.

👇 Watch the video below up to 7:52 to hear the full story

Why Win-Loss Matters

When your company loses deals, everyone has an opinion around why. But rarely do those opinions come from the people who actually made the decision: the buyers.

During my time at Gartner, I was advising a CIO who was looking to purchase an ERP platform. One potential vendor (actually his preferred option) kept disappointing him during the sales process. They weren’t responsive, gave surface-level answers to his most important questions, and generally seemed indifferent to winning his business. As a result, he ended up going with the second-place vendor.

The preferred vendor lost a $40mil deal!

And to make matters worse, they never even knew why, because they never followed up to ask.

If they had, they could have learned from their mistakes and made a change to their sales process. Instead, they likely continued to lose millions due to very solvable problems.

👇 Watch the video below up to 7:52 to hear the full story

Why Win-Loss Matters

When your company loses deals, everyone has an opinion around why. But rarely do those opinions come from the people who actually made the decision: the buyers.

During my time at Gartner, I was advising a CIO who was looking to purchase an ERP platform. One potential vendor (actually his preferred option) kept disappointing him during the sales process. They weren’t responsive, gave surface-level answers to his most important questions, and generally seemed indifferent to winning his business. As a result, he ended up going with the second-place vendor.

The preferred vendor lost a $40mil deal!

And to make matters worse, they never even knew why, because they never followed up to ask.

If they had, they could have learned from their mistakes and made a change to their sales process. Instead, they likely continued to lose millions due to very solvable problems.

👇 Watch the video below up to 7:52 to hear the full story

That’s just one example illustrating what can happen when companies don’t conduct win-loss interviews.

But for those that do, the benefits can be huge. A well-run win-loss program can help you:

Identify blind spots in your sales process and messaging

Understand how buyers perceive your differentiation

Strengthen enablement, pricing, and positioning strategies

Confidently defend your roadmap and go-to-market priorities

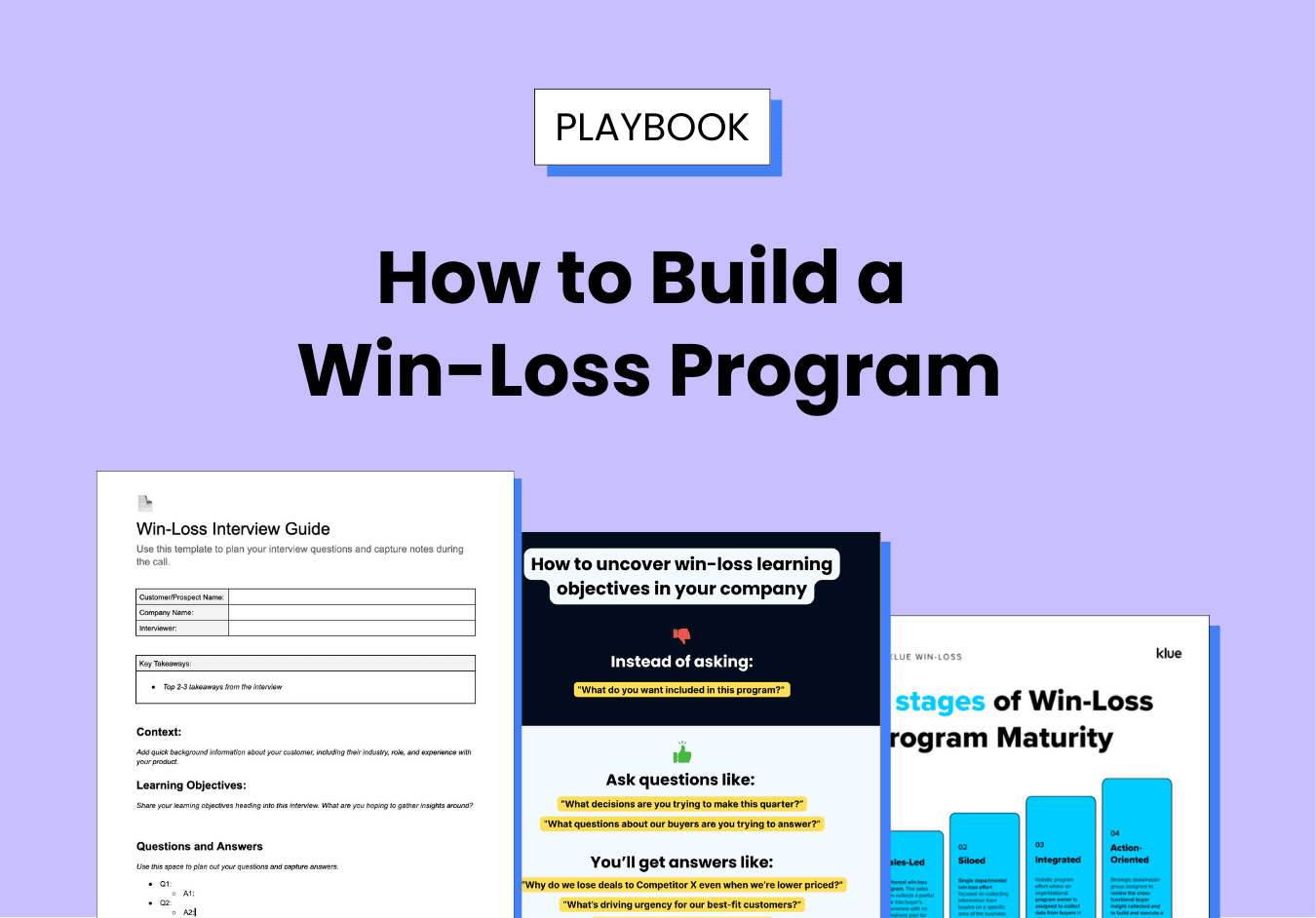

The Four Stages of Win-Loss Maturity

Every company thinks they have a win-loss program, but in reality, most are just collecting random anecdotes.

A truly mature program doesn’t happen overnight; it evolves over time. In fact, there are four stages of win-loss maturity.

That’s just one example illustrating what can happen when companies don’t conduct win-loss interviews.

But for those that do, the benefits can be huge. A well-run win-loss program can help you:

Identify blind spots in your sales process and messaging

Understand how buyers perceive your differentiation

Strengthen enablement, pricing, and positioning strategies

Confidently defend your roadmap and go-to-market priorities

The Four Stages of Win-Loss Maturity

Every company thinks they have a win-loss program, but in reality, most are just collecting random anecdotes.

A truly mature program doesn’t happen overnight; it evolves over time. In fact, there are four stages of win-loss maturity.

That’s just one example illustrating what can happen when companies don’t conduct win-loss interviews.

But for those that do, the benefits can be huge. A well-run win-loss program can help you:

Identify blind spots in your sales process and messaging

Understand how buyers perceive your differentiation

Strengthen enablement, pricing, and positioning strategies

Confidently defend your roadmap and go-to-market priorities

The Four Stages of Win-Loss Maturity

Every company thinks they have a win-loss program, but in reality, most are just collecting random anecdotes.

A truly mature program doesn’t happen overnight; it evolves over time. In fact, there are four stages of win-loss maturity.

Stage 1: Sales-Led

Companies in this stage have no formal win-loss program. Their sales reps may gather anecdotal insights and share them ad hoc. Whether it’s in a Slack channel or open-text CRM field.

Interviews happen reactively, often after a painful loss or a big deal slipping away. And there’s no process or alignment on what you’re trying to learn.

What it looks like:

A few one-off interviews after major deals

Notes living in personal Google Docs, Slack threads, or your CRM

Little to no reporting back to leadership

How to elevate from here: Just get started. Pick one or two lost deals, reach out to the buyers, and start uncovering patterns. You’re not trying to achieve perfection, but just focus on building momentum.

Stage 2: Siloed

At this stage, win-loss is happening within a single departmental with the sole mission of gathering insights for that team. Maybe Sales Ops runs a quarterly survey, or Marketing owns a few interviews per launch.

Insights start to appear, but they’re rarely shared with other teams or actioned on.

What it looks like:

A single owner (usually Sales, Product, or Product Marketing)

Inconsistent reporting cadence

Data lives in spreadsheets or slide decks

Findings are sometimes shared, but often not acted on

How to elevate from here: Get from collection to collaboration. Start sharing results cross-functionally and inviting other teams into the process.

Stage 3: Integrated

A holistic program is starting to take shape. Your win-loss program has a clear owner and objectives, a regular cadence, and buy-in across multiple departments.

Win-loss insights become a shared language for understanding performance and and influencing strategy.

What it looks like:

A dedicated owner or team running the program

There’s a central repository for interview data and insights

Regular readouts that are tied to key metrics (e.g., win rate, NPS, churn reasons)

You’re having discussions that start with “Here’s what buyers told us…”

How to elevate from here: Build a rhythm. Win-loss becomes part of how the company regularly operates, rather than an ad-hoc research project.

Stage 4: Action-Oriented

You’ve reached peak win-loss maturity. At this level, your win-loss program isn’t just analyzing the past — it’s shaping the future. Insights drive real decisions about product strategy, pricing, enablement, and go-to-market investments. Executives rely on the program as an essential business input.

What it looks like:

Cross-functional steering group (Sales, Product, Marketing, CS)

Formal quarterly readouts to execs and GTM teams

Closed-loop reporting on actions taken from insights

Tracking how insights influence win rates, deal velocity, and revenue

How to continue elevating: Maintain momentum. Keep evolving the program’s scope and credibility by showing clear ROI from your insights.

Getting Stakeholder Buy-In

Have you ever struggled to get access to a prospect or customer, like a sales rep refusing to introduce you? Or have you presented insights gathered from buyer interviews, only to encounter pushback and resistance from internal stakeholders?

If so, you're not alone — these are common frustrations that stem from one fundamental issue: forgetting stakeholder buy-in.

A win-loss program isn’t just about collecting data and generating reports. It’s about creating a culture where all of your teams have a stake in the outcome and feel invested in the program’s success.

If you design your program behind closed doors and only reveal your findings after the fact, you’ll almost always face skepticism, indifference, or outright pushback.

A successful win-loss program isn’t built for your internal stakeholders — it’s built with them.

Start by Mapping Your Internal Stakeholders

Every function within your organization plays a role in shaping the buyer’s journey, and each one brings unique insights, concerns, and blind spots to the table.

Your first step is to identify who those stakeholders are and understand what actually matters to them.

Common stakeholder groups include:

CEO / Leadership: They care about gaining strategic clarity. Questions like, “Why are we really winning or losing in our core markets?” help them understand overarching trends and high-level causes.

Sales Leaders: Their primary concern is deal dynamics and objections. They’re asking, “Where do reps get stuck? What’s keeping us from closing more deals?” Insights here can inform coaching, training, and process improvements.

Product: They’re interested in feature gaps, usability friction, and whether the current roadmap aligns with customer needs. Their question might be, “Why do buyers often choose competitors, and how can we plug those gaps?”

Marketing: This group is all about positioning, messaging, and differentiation. They want to know, “What resonates with our buyers, and what’s falling flat?” Insights can help refine campaigns and content.

Customer Success: They’re focused on long-term value, expansion opportunities, and churn reasons. Their key question: “What are the blockers preventing us from expanding within existing accounts or retaining customers?”

Each group sits at the end of a “spoke” — and your program becomes the hub that ties their needs together.

Stage 1: Sales-Led

Companies in this stage have no formal win-loss program. Their sales reps may gather anecdotal insights and share them ad hoc. Whether it’s in a Slack channel or open-text CRM field.

Interviews happen reactively, often after a painful loss or a big deal slipping away. And there’s no process or alignment on what you’re trying to learn.

What it looks like:

A few one-off interviews after major deals

Notes living in personal Google Docs, Slack threads, or your CRM

Little to no reporting back to leadership

How to elevate from here: Just get started. Pick one or two lost deals, reach out to the buyers, and start uncovering patterns. You’re not trying to achieve perfection, but just focus on building momentum.

Stage 2: Siloed

At this stage, win-loss is happening within a single departmental with the sole mission of gathering insights for that team. Maybe Sales Ops runs a quarterly survey, or Marketing owns a few interviews per launch.

Insights start to appear, but they’re rarely shared with other teams or actioned on.

What it looks like:

A single owner (usually Sales, Product, or Product Marketing)

Inconsistent reporting cadence

Data lives in spreadsheets or slide decks

Findings are sometimes shared, but often not acted on

How to elevate from here: Get from collection to collaboration. Start sharing results cross-functionally and inviting other teams into the process.

Stage 3: Integrated

A holistic program is starting to take shape. Your win-loss program has a clear owner and objectives, a regular cadence, and buy-in across multiple departments.

Win-loss insights become a shared language for understanding performance and and influencing strategy.

What it looks like:

A dedicated owner or team running the program

There’s a central repository for interview data and insights

Regular readouts that are tied to key metrics (e.g., win rate, NPS, churn reasons)

You’re having discussions that start with “Here’s what buyers told us…”

How to elevate from here: Build a rhythm. Win-loss becomes part of how the company regularly operates, rather than an ad-hoc research project.

Stage 4: Action-Oriented

You’ve reached peak win-loss maturity. At this level, your win-loss program isn’t just analyzing the past — it’s shaping the future. Insights drive real decisions about product strategy, pricing, enablement, and go-to-market investments. Executives rely on the program as an essential business input.

What it looks like:

Cross-functional steering group (Sales, Product, Marketing, CS)

Formal quarterly readouts to execs and GTM teams

Closed-loop reporting on actions taken from insights

Tracking how insights influence win rates, deal velocity, and revenue

How to continue elevating: Maintain momentum. Keep evolving the program’s scope and credibility by showing clear ROI from your insights.

Getting Stakeholder Buy-In

Have you ever struggled to get access to a prospect or customer, like a sales rep refusing to introduce you? Or have you presented insights gathered from buyer interviews, only to encounter pushback and resistance from internal stakeholders?

If so, you're not alone — these are common frustrations that stem from one fundamental issue: forgetting stakeholder buy-in.

A win-loss program isn’t just about collecting data and generating reports. It’s about creating a culture where all of your teams have a stake in the outcome and feel invested in the program’s success.

If you design your program behind closed doors and only reveal your findings after the fact, you’ll almost always face skepticism, indifference, or outright pushback.

A successful win-loss program isn’t built for your internal stakeholders — it’s built with them.

Start by Mapping Your Internal Stakeholders

Every function within your organization plays a role in shaping the buyer’s journey, and each one brings unique insights, concerns, and blind spots to the table.

Your first step is to identify who those stakeholders are and understand what actually matters to them.

Common stakeholder groups include:

CEO / Leadership: They care about gaining strategic clarity. Questions like, “Why are we really winning or losing in our core markets?” help them understand overarching trends and high-level causes.

Sales Leaders: Their primary concern is deal dynamics and objections. They’re asking, “Where do reps get stuck? What’s keeping us from closing more deals?” Insights here can inform coaching, training, and process improvements.

Product: They’re interested in feature gaps, usability friction, and whether the current roadmap aligns with customer needs. Their question might be, “Why do buyers often choose competitors, and how can we plug those gaps?”

Marketing: This group is all about positioning, messaging, and differentiation. They want to know, “What resonates with our buyers, and what’s falling flat?” Insights can help refine campaigns and content.

Customer Success: They’re focused on long-term value, expansion opportunities, and churn reasons. Their key question: “What are the blockers preventing us from expanding within existing accounts or retaining customers?”

Each group sits at the end of a “spoke” — and your program becomes the hub that ties their needs together.

Stage 1: Sales-Led

Companies in this stage have no formal win-loss program. Their sales reps may gather anecdotal insights and share them ad hoc. Whether it’s in a Slack channel or open-text CRM field.

Interviews happen reactively, often after a painful loss or a big deal slipping away. And there’s no process or alignment on what you’re trying to learn.

What it looks like:

A few one-off interviews after major deals

Notes living in personal Google Docs, Slack threads, or your CRM

Little to no reporting back to leadership

How to elevate from here: Just get started. Pick one or two lost deals, reach out to the buyers, and start uncovering patterns. You’re not trying to achieve perfection, but just focus on building momentum.

Stage 2: Siloed

At this stage, win-loss is happening within a single departmental with the sole mission of gathering insights for that team. Maybe Sales Ops runs a quarterly survey, or Marketing owns a few interviews per launch.

Insights start to appear, but they’re rarely shared with other teams or actioned on.

What it looks like:

A single owner (usually Sales, Product, or Product Marketing)

Inconsistent reporting cadence

Data lives in spreadsheets or slide decks

Findings are sometimes shared, but often not acted on

How to elevate from here: Get from collection to collaboration. Start sharing results cross-functionally and inviting other teams into the process.

Stage 3: Integrated

A holistic program is starting to take shape. Your win-loss program has a clear owner and objectives, a regular cadence, and buy-in across multiple departments.

Win-loss insights become a shared language for understanding performance and and influencing strategy.

What it looks like:

A dedicated owner or team running the program

There’s a central repository for interview data and insights

Regular readouts that are tied to key metrics (e.g., win rate, NPS, churn reasons)

You’re having discussions that start with “Here’s what buyers told us…”

How to elevate from here: Build a rhythm. Win-loss becomes part of how the company regularly operates, rather than an ad-hoc research project.

Stage 4: Action-Oriented

You’ve reached peak win-loss maturity. At this level, your win-loss program isn’t just analyzing the past — it’s shaping the future. Insights drive real decisions about product strategy, pricing, enablement, and go-to-market investments. Executives rely on the program as an essential business input.

What it looks like:

Cross-functional steering group (Sales, Product, Marketing, CS)

Formal quarterly readouts to execs and GTM teams

Closed-loop reporting on actions taken from insights

Tracking how insights influence win rates, deal velocity, and revenue

How to continue elevating: Maintain momentum. Keep evolving the program’s scope and credibility by showing clear ROI from your insights.

Getting Stakeholder Buy-In

Have you ever struggled to get access to a prospect or customer, like a sales rep refusing to introduce you? Or have you presented insights gathered from buyer interviews, only to encounter pushback and resistance from internal stakeholders?

If so, you're not alone — these are common frustrations that stem from one fundamental issue: forgetting stakeholder buy-in.

A win-loss program isn’t just about collecting data and generating reports. It’s about creating a culture where all of your teams have a stake in the outcome and feel invested in the program’s success.

If you design your program behind closed doors and only reveal your findings after the fact, you’ll almost always face skepticism, indifference, or outright pushback.

A successful win-loss program isn’t built for your internal stakeholders — it’s built with them.

Start by Mapping Your Internal Stakeholders

Every function within your organization plays a role in shaping the buyer’s journey, and each one brings unique insights, concerns, and blind spots to the table.

Your first step is to identify who those stakeholders are and understand what actually matters to them.

Common stakeholder groups include:

CEO / Leadership: They care about gaining strategic clarity. Questions like, “Why are we really winning or losing in our core markets?” help them understand overarching trends and high-level causes.

Sales Leaders: Their primary concern is deal dynamics and objections. They’re asking, “Where do reps get stuck? What’s keeping us from closing more deals?” Insights here can inform coaching, training, and process improvements.

Product: They’re interested in feature gaps, usability friction, and whether the current roadmap aligns with customer needs. Their question might be, “Why do buyers often choose competitors, and how can we plug those gaps?”

Marketing: This group is all about positioning, messaging, and differentiation. They want to know, “What resonates with our buyers, and what’s falling flat?” Insights can help refine campaigns and content.

Customer Success: They’re focused on long-term value, expansion opportunities, and churn reasons. Their key question: “What are the blockers preventing us from expanding within existing accounts or retaining customers?”

Each group sits at the end of a “spoke” — and your program becomes the hub that ties their needs together.

Template - The Win-Loss Program Tracker

We've created a simple template to help you manage your win-loss program, including your Stakeholder Alignment Canvas: where you can map your internal stakeholders and what they care about:

Win-Loss Program Tracker Template

Template - The Win-Loss Program Tracker

We've created a simple template to help you manage your win-loss program, including your Stakeholder Alignment Canvas: where you can map your internal stakeholders and what they care about:

Win-Loss Program Tracker Template

Template - The Win-Loss Program Tracker

We've created a simple template to help you manage your win-loss program, including your Stakeholder Alignment Canvas: where you can map your internal stakeholders and what they care about:

Win-Loss Program Tracker Template

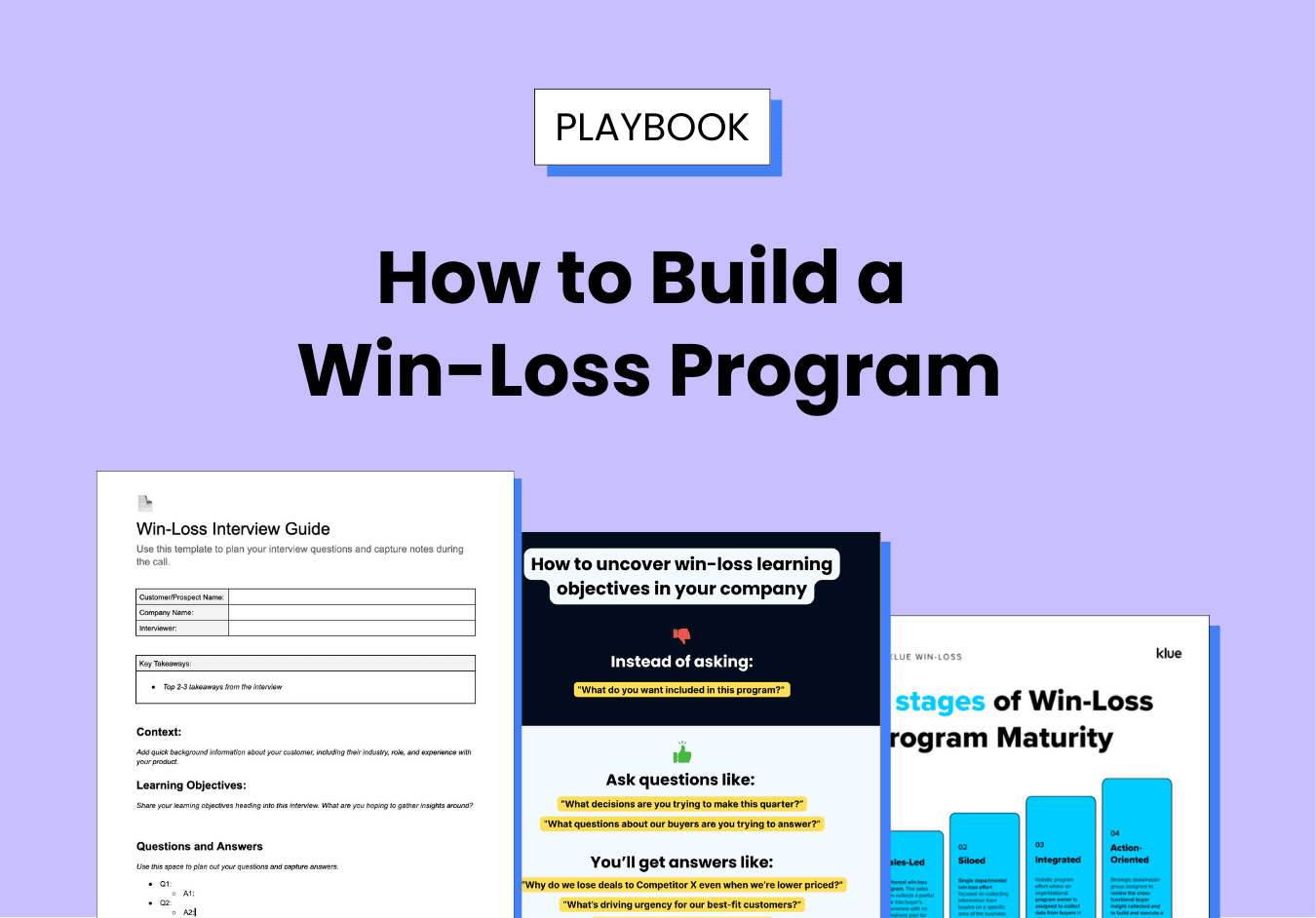

Turn Their Questions Into Learning Objectives

Your teams are not interested in research for research’s sake. They want clear, actionable answers to business-critical questions.

Instead of asking them, “What do you want included in this program?” — which can lead to a laundry list of disconnected requests — try shifting the conversation to their core needs with questions like:

“What decisions are you trying to make this quarter?”

“What questions about our buyers are you trying to answer?”

By framing it this way, you help them articulate their most pressing concerns. They might say things like:

“Why do we lose deals to Competitor X even when we’re lower priced?”

“What’s driving urgency for our best-fit customers?”

“Is our demo hurting us or helping us?”

“What factors matter most in late-stage deals?”

Turn Their Questions Into Learning Objectives

Your teams are not interested in research for research’s sake. They want clear, actionable answers to business-critical questions.

Instead of asking them, “What do you want included in this program?” — which can lead to a laundry list of disconnected requests — try shifting the conversation to their core needs with questions like:

“What decisions are you trying to make this quarter?”

“What questions about our buyers are you trying to answer?”

By framing it this way, you help them articulate their most pressing concerns. They might say things like:

“Why do we lose deals to Competitor X even when we’re lower priced?”

“What’s driving urgency for our best-fit customers?”

“Is our demo hurting us or helping us?”

“What factors matter most in late-stage deals?”

Turn Their Questions Into Learning Objectives

Your teams are not interested in research for research’s sake. They want clear, actionable answers to business-critical questions.

Instead of asking them, “What do you want included in this program?” — which can lead to a laundry list of disconnected requests — try shifting the conversation to their core needs with questions like:

“What decisions are you trying to make this quarter?”

“What questions about our buyers are you trying to answer?”

By framing it this way, you help them articulate their most pressing concerns. They might say things like:

“Why do we lose deals to Competitor X even when we’re lower priced?”

“What’s driving urgency for our best-fit customers?”

“Is our demo hurting us or helping us?”

“What factors matter most in late-stage deals?”

These questions then become the learning objectives; the foundational goals that guide your entire win-loss program.

Create Ongoing Collaboration, Not One-Time Alignment

Stakeholder buy-in isn’t just a kickoff meeting. It’s a consistent rhythm. Successful PMMs understand this, and they establish mechanisms to keep collaborators involved and informed throughout the process.

Here are some key practices:

A dedicated Slack/Teams channel for sharing early insights

Monthly or quarterly win-loss readout sessions

A standing “steering group” with Sales, Product, and Leadership

Early previews of anonymized quotes and emerging patterns

When every department sees you working in the open, they feel more confidence and ownership over the program. This helps to embed the win-loss program into the fabric of your organization, turning it into a continuous learning process rather than a one-time project.

Use the Win-Loss Stakeholder Alignment Canvas to keep everyone aligned around the goals of your win-loss program. This becomes your source of truth as you design the program.

These questions then become the learning objectives; the foundational goals that guide your entire win-loss program.

Create Ongoing Collaboration, Not One-Time Alignment

Stakeholder buy-in isn’t just a kickoff meeting. It’s a consistent rhythm. Successful PMMs understand this, and they establish mechanisms to keep collaborators involved and informed throughout the process.

Here are some key practices:

A dedicated Slack/Teams channel for sharing early insights

Monthly or quarterly win-loss readout sessions

A standing “steering group” with Sales, Product, and Leadership

Early previews of anonymized quotes and emerging patterns

When every department sees you working in the open, they feel more confidence and ownership over the program. This helps to embed the win-loss program into the fabric of your organization, turning it into a continuous learning process rather than a one-time project.

Use the Win-Loss Stakeholder Alignment Canvas to keep everyone aligned around the goals of your win-loss program. This becomes your source of truth as you design the program.

These questions then become the learning objectives; the foundational goals that guide your entire win-loss program.

Create Ongoing Collaboration, Not One-Time Alignment

Stakeholder buy-in isn’t just a kickoff meeting. It’s a consistent rhythm. Successful PMMs understand this, and they establish mechanisms to keep collaborators involved and informed throughout the process.

Here are some key practices:

A dedicated Slack/Teams channel for sharing early insights

Monthly or quarterly win-loss readout sessions

A standing “steering group” with Sales, Product, and Leadership

Early previews of anonymized quotes and emerging patterns

When every department sees you working in the open, they feel more confidence and ownership over the program. This helps to embed the win-loss program into the fabric of your organization, turning it into a continuous learning process rather than a one-time project.

Use the Win-Loss Stakeholder Alignment Canvas to keep everyone aligned around the goals of your win-loss program. This becomes your source of truth as you design the program.

Pro tip: Remember that the whole point of win-loss is to help your company make better decisions.

Pro tip: Remember that the whole point of win-loss is to help your company make better decisions.

Pro tip: Remember that the whole point of win-loss is to help your company make better decisions.

Template - The Win-Loss Program Tracker

We've created a simple template to help you manage your win-loss program, including your Stakeholder Alignment Canvas: where you can map your internal stakeholders and what they care about:

Win-Loss Program Tracker Template

Template - The Win-Loss Program Tracker

We've created a simple template to help you manage your win-loss program, including your Stakeholder Alignment Canvas: where you can map your internal stakeholders and what they care about:

Win-Loss Program Tracker Template

Template - The Win-Loss Program Tracker

We've created a simple template to help you manage your win-loss program, including your Stakeholder Alignment Canvas: where you can map your internal stakeholders and what they care about:

Win-Loss Program Tracker Template

Designing the Program

A strong win-loss program is designed before it’s executed.

The biggest mistake PMMs make is jumping straight into interviews without clarity on what they’re trying to learn, how they’ll collect the data, or how broad the program should be.

Think of this stage as building the blueprint for a truth engine your company will rely on for quarters (or years) to come.

Define Your Learning Objectives

Remember all that work you did in the previous section to align your stakeholders and understand their learning objectives?

Now it’s time to select which learning objectives are going to influence your win-loss program, or at least this current stage of it.

These objectives ensure your interviews follow a consistent path instead of bouncing from topic to topic. Equally important, they foster buy-in and frame how you’ll present your learnings later on.

Set Your Cadence

Win-loss only works when it becomes a habit, not a one-off initiative. The goal isn’t volume, it’s consistency.

Start with a manageable rhythm:

Conduct 5–10 interviews per quarter, balanced between wins and losses.

Focus on deals that represent your ideal customer profile (ICP), strategic segments, or key competitors.

Maintain a pipeline of interview candidates so you’re never scrambling to find participants.

A steady drumbeat of insights will build credibility, and it shows the company that you’re operating a real program, not just an ad-hoc exercise.

Mix Methods: Qualitative + Quantitative

Interviews give depth. Surveys give breadth. CRM data gives context. Relying on a single method limits what insights you can uncover. You need all three.

Qualitative (Interviews): Deep, open-ended conversations that reveal motivations, perceptions, deal dynamics, objections, and decision criteria.

Quantitative (Surveys): Short, structured questions sent broadly to validate themes in a scalable way.

Operational (CRM Data): Account data, deal stage progression, competitor tags, and rep-provided win/loss reasons help add context.

Using all three methods paints a richer, more accurate story.

Define Your Scope (Start Narrow)

A common trap is trying to interview every buyer type across every region for every deal type. Don’t do that. Instead, start small.

Narrow your initial program to one of the following:

A single persona

A single segment (e.g., mid-market)

A single competitor you’re losing to

A single use case or product line

A specific stage where deals frequently stall

For each quarter, your learning objectives will help determine the scope of your interview pool. A nice side effect is that it’ll force you to get more specific in the questions you’re looking to answer.

Once the process works — and you’ve proven the value of the insights — you can consider expanding the program’s scope.

I like to use the metaphor of a Mountain Range when thinking about my learning objectives and how they all work together.

Designing the Program

A strong win-loss program is designed before it’s executed.

The biggest mistake PMMs make is jumping straight into interviews without clarity on what they’re trying to learn, how they’ll collect the data, or how broad the program should be.

Think of this stage as building the blueprint for a truth engine your company will rely on for quarters (or years) to come.

Define Your Learning Objectives

Remember all that work you did in the previous section to align your stakeholders and understand their learning objectives?

Now it’s time to select which learning objectives are going to influence your win-loss program, or at least this current stage of it.

These objectives ensure your interviews follow a consistent path instead of bouncing from topic to topic. Equally important, they foster buy-in and frame how you’ll present your learnings later on.

Set Your Cadence

Win-loss only works when it becomes a habit, not a one-off initiative. The goal isn’t volume, it’s consistency.

Start with a manageable rhythm:

Conduct 5–10 interviews per quarter, balanced between wins and losses.

Focus on deals that represent your ideal customer profile (ICP), strategic segments, or key competitors.

Maintain a pipeline of interview candidates so you’re never scrambling to find participants.

A steady drumbeat of insights will build credibility, and it shows the company that you’re operating a real program, not just an ad-hoc exercise.

Mix Methods: Qualitative + Quantitative

Interviews give depth. Surveys give breadth. CRM data gives context. Relying on a single method limits what insights you can uncover. You need all three.

Qualitative (Interviews): Deep, open-ended conversations that reveal motivations, perceptions, deal dynamics, objections, and decision criteria.

Quantitative (Surveys): Short, structured questions sent broadly to validate themes in a scalable way.

Operational (CRM Data): Account data, deal stage progression, competitor tags, and rep-provided win/loss reasons help add context.

Using all three methods paints a richer, more accurate story.

Define Your Scope (Start Narrow)

A common trap is trying to interview every buyer type across every region for every deal type. Don’t do that. Instead, start small.

Narrow your initial program to one of the following:

A single persona

A single segment (e.g., mid-market)

A single competitor you’re losing to

A single use case or product line

A specific stage where deals frequently stall

For each quarter, your learning objectives will help determine the scope of your interview pool. A nice side effect is that it’ll force you to get more specific in the questions you’re looking to answer.

Once the process works — and you’ve proven the value of the insights — you can consider expanding the program’s scope.

I like to use the metaphor of a Mountain Range when thinking about my learning objectives and how they all work together.

Designing the Program

A strong win-loss program is designed before it’s executed.

The biggest mistake PMMs make is jumping straight into interviews without clarity on what they’re trying to learn, how they’ll collect the data, or how broad the program should be.

Think of this stage as building the blueprint for a truth engine your company will rely on for quarters (or years) to come.

Define Your Learning Objectives

Remember all that work you did in the previous section to align your stakeholders and understand their learning objectives?

Now it’s time to select which learning objectives are going to influence your win-loss program, or at least this current stage of it.

These objectives ensure your interviews follow a consistent path instead of bouncing from topic to topic. Equally important, they foster buy-in and frame how you’ll present your learnings later on.

Set Your Cadence

Win-loss only works when it becomes a habit, not a one-off initiative. The goal isn’t volume, it’s consistency.

Start with a manageable rhythm:

Conduct 5–10 interviews per quarter, balanced between wins and losses.

Focus on deals that represent your ideal customer profile (ICP), strategic segments, or key competitors.

Maintain a pipeline of interview candidates so you’re never scrambling to find participants.

A steady drumbeat of insights will build credibility, and it shows the company that you’re operating a real program, not just an ad-hoc exercise.

Mix Methods: Qualitative + Quantitative

Interviews give depth. Surveys give breadth. CRM data gives context. Relying on a single method limits what insights you can uncover. You need all three.

Qualitative (Interviews): Deep, open-ended conversations that reveal motivations, perceptions, deal dynamics, objections, and decision criteria.

Quantitative (Surveys): Short, structured questions sent broadly to validate themes in a scalable way.

Operational (CRM Data): Account data, deal stage progression, competitor tags, and rep-provided win/loss reasons help add context.

Using all three methods paints a richer, more accurate story.

Define Your Scope (Start Narrow)

A common trap is trying to interview every buyer type across every region for every deal type. Don’t do that. Instead, start small.

Narrow your initial program to one of the following:

A single persona

A single segment (e.g., mid-market)

A single competitor you’re losing to

A single use case or product line

A specific stage where deals frequently stall

For each quarter, your learning objectives will help determine the scope of your interview pool. A nice side effect is that it’ll force you to get more specific in the questions you’re looking to answer.

Once the process works — and you’ve proven the value of the insights — you can consider expanding the program’s scope.

I like to use the metaphor of a Mountain Range when thinking about my learning objectives and how they all work together.

Each mountain peak represents a specific learning objective or question. Know which questions are your highest priorities — your “high peaks” — and which are smaller, “lower peaks” that still matter but are less critical on this round.

On each of these mountains, there are snow caps. Think of these as smaller, more scalable data collection opportunities, like online surveys. They give you broader insights that can validate what you’re discovering from interviews.

The base of the mountain is where you do your most detailed, open-ended interviews. Like the roots of a mountain, these gather rich, nuanced insights that only come from one-on-one conversations.

And the valley at the bottom? That’s where all these insights connect, revealing patterns that lead to strategic decisions and actionable changes.

👇 Watch 2 mins of the clip below to better understand the Mountain Range concept.

Each mountain peak represents a specific learning objective or question. Know which questions are your highest priorities — your “high peaks” — and which are smaller, “lower peaks” that still matter but are less critical on this round.

On each of these mountains, there are snow caps. Think of these as smaller, more scalable data collection opportunities, like online surveys. They give you broader insights that can validate what you’re discovering from interviews.

The base of the mountain is where you do your most detailed, open-ended interviews. Like the roots of a mountain, these gather rich, nuanced insights that only come from one-on-one conversations.

And the valley at the bottom? That’s where all these insights connect, revealing patterns that lead to strategic decisions and actionable changes.

👇 Watch 2 mins of the clip below to better understand the Mountain Range concept.

Each mountain peak represents a specific learning objective or question. Know which questions are your highest priorities — your “high peaks” — and which are smaller, “lower peaks” that still matter but are less critical on this round.

On each of these mountains, there are snow caps. Think of these as smaller, more scalable data collection opportunities, like online surveys. They give you broader insights that can validate what you’re discovering from interviews.

The base of the mountain is where you do your most detailed, open-ended interviews. Like the roots of a mountain, these gather rich, nuanced insights that only come from one-on-one conversations.

And the valley at the bottom? That’s where all these insights connect, revealing patterns that lead to strategic decisions and actionable changes.

👇 Watch 2 mins of the clip below to better understand the Mountain Range concept.

Building the Interview Framework

A great win-loss interview isn’t just about asking questions, it’s about telling the story of your buyer’s journey.

Instead of jumping straight into product feedback or pricing objections, you start at the beginning — the moment they recognized they had a problem — and follow their path all the way to their final decision.

If you’ve read Playbook #15: Buyer Journey Mapping, this will feel familiar. The buyer’s journey is the backbone of your interview framework. You’re retracing the exact steps the buyer walked, but this time with their commentary, emotion, and reasoning attached.

Building the Interview Framework

A great win-loss interview isn’t just about asking questions, it’s about telling the story of your buyer’s journey.

Instead of jumping straight into product feedback or pricing objections, you start at the beginning — the moment they recognized they had a problem — and follow their path all the way to their final decision.

If you’ve read Playbook #15: Buyer Journey Mapping, this will feel familiar. The buyer’s journey is the backbone of your interview framework. You’re retracing the exact steps the buyer walked, but this time with their commentary, emotion, and reasoning attached.

Building the Interview Framework

A great win-loss interview isn’t just about asking questions, it’s about telling the story of your buyer’s journey.

Instead of jumping straight into product feedback or pricing objections, you start at the beginning — the moment they recognized they had a problem — and follow their path all the way to their final decision.

If you’ve read Playbook #15: Buyer Journey Mapping, this will feel familiar. The buyer’s journey is the backbone of your interview framework. You’re retracing the exact steps the buyer walked, but this time with their commentary, emotion, and reasoning attached.

If you want a deeper dive into mapping how buyers think, evaluate, and make decisions, revisit our dedicated playbook on Buyer Journey Mapping.

Playbook #15: Buyer Journey Mapping

If you want a deeper dive into mapping how buyers think, evaluate, and make decisions, revisit our dedicated playbook on Buyer Journey Mapping.

Playbook #15: Buyer Journey Mapping

If you want a deeper dive into mapping how buyers think, evaluate, and make decisions, revisit our dedicated playbook on Buyer Journey Mapping.

Playbook #15: Buyer Journey Mapping

The same journey your PMM team maps for messaging and enablement is the journey you’ll explore in win-loss conversations — except this time, you’re hearing it directly from the buyer.

Use the typical buyer journey stages as your anchor:

Awareness - How they first recognized the problem, what triggered the project, and what pain or change created urgency.

Consideration - Which options they evaluated, how they built their shortlist, and what factors guided their exploration.

Decision - How they compared vendors, what mattered most late in the cycle, what objections surfaced, and what tipped the scales.

Post-Decision - What reinforced or hurt confidence, what sealed or broke the deal, and what advice they’d give your team.

The same journey your PMM team maps for messaging and enablement is the journey you’ll explore in win-loss conversations — except this time, you’re hearing it directly from the buyer.

Use the typical buyer journey stages as your anchor:

Awareness - How they first recognized the problem, what triggered the project, and what pain or change created urgency.

Consideration - Which options they evaluated, how they built their shortlist, and what factors guided their exploration.

Decision - How they compared vendors, what mattered most late in the cycle, what objections surfaced, and what tipped the scales.

Post-Decision - What reinforced or hurt confidence, what sealed or broke the deal, and what advice they’d give your team.

The same journey your PMM team maps for messaging and enablement is the journey you’ll explore in win-loss conversations — except this time, you’re hearing it directly from the buyer.

Use the typical buyer journey stages as your anchor:

Awareness - How they first recognized the problem, what triggered the project, and what pain or change created urgency.

Consideration - Which options they evaluated, how they built their shortlist, and what factors guided their exploration.

Decision - How they compared vendors, what mattered most late in the cycle, what objections surfaced, and what tipped the scales.

Post-Decision - What reinforced or hurt confidence, what sealed or broke the deal, and what advice they’d give your team.

This structure of starting broad and gradually narrowing will help guide the buyer through their story logically.

It also creates a natural storytelling arc. They’re sharing their experience in a way that’s intuitive and human. This makes interviews more engaging, genuine, and revealing.

If you’re following their journey in order, you can expect to uncover a wealth of insights, such as:

Early signals that sparked urgency or awareness

Key influencers and internal politics that shaped their choices

Hidden competitors or alternatives that influenced their thinking

Friction points in your sales process, demos, or evaluations

Moments of delight or disappointment that impacted their perception

Late-stage surprises that unexpectedly shifted the outcome

Running Great Interviews

Remember: a win-loss interview isn’t an interrogation. It’s a relaxed conversation where the buyer feels comfortable sharing the honest truth.

The quality of your interview depends less on what you ask, and far more on how you ask it. Your role is to create a space of curiosity, neutrality, and genuine interest.

Here’s how to run interviews that actually uncover what happened in the deal.

Use a Neutral Third-Party Interviewer When Possible

Buyers tend to speak more freely when they don’t think they’re talking to someone with an agenda.

If a salesperson or PM interviews a prospect, they may hold back critique fearing it could reflect poorly on them or their team.

If CS interviews a customer, they may soften their complaints or avoid mentioning sensitive issues, wanting to keep the relationship positive.

A Product Marketer often makes an ideal interviewer. They’re seen as a trusted, impartial voice: connected enough to understand the context, but not emotionally tied to whether the deal was a win or loss. This perspective encourages honest, candid responses and leads to richer insights.

Start Warm (Always)

Never dive straight into the decision. Instead, kick off the interview with a warm, simple question that helps the buyer feel comfortable and at ease:

“Can you walk me through how this project began?”

“Before we talk about vendors, can you tell me what problem you were trying to solve?”

“What was the moment when this became a priority?”

Starting with these warm, easy questions helps build rapport, relaxes the buyer, and gives you important context for everything that follows.

Keep Questions Open-Ended, Not Leading

It’s tempting to ask questions that steer the buyer toward certain answers, but this introduces bias and can distort the true story.

❌ Instead of: “Was the product too complex?”

✅ Ask: “What was your impression of the product?”

❌ Instead of: “Did price affect your decision?”

✅ Ask: “What factors mattered most when you compared options?”

Practice The 5 Why’s Approach

One common mistake interviewers make is stopping at the first vague or superficial answer.

When a buyer mentions something interesting or important, don’t just accept it at face value. Dig deeper.

Start by asking “why?” after their initial response. For example, if they say, “Price was a concern,” follow up with, “Why was price a concern?” If they answer, ask again, “Why does that matter?” Keep going — usually about 4-5 times — until you reach the real root cause.

This structure of starting broad and gradually narrowing will help guide the buyer through their story logically.

It also creates a natural storytelling arc. They’re sharing their experience in a way that’s intuitive and human. This makes interviews more engaging, genuine, and revealing.

If you’re following their journey in order, you can expect to uncover a wealth of insights, such as:

Early signals that sparked urgency or awareness

Key influencers and internal politics that shaped their choices

Hidden competitors or alternatives that influenced their thinking

Friction points in your sales process, demos, or evaluations

Moments of delight or disappointment that impacted their perception

Late-stage surprises that unexpectedly shifted the outcome

Running Great Interviews

Remember: a win-loss interview isn’t an interrogation. It’s a relaxed conversation where the buyer feels comfortable sharing the honest truth.

The quality of your interview depends less on what you ask, and far more on how you ask it. Your role is to create a space of curiosity, neutrality, and genuine interest.

Here’s how to run interviews that actually uncover what happened in the deal.

Use a Neutral Third-Party Interviewer When Possible

Buyers tend to speak more freely when they don’t think they’re talking to someone with an agenda.

If a salesperson or PM interviews a prospect, they may hold back critique fearing it could reflect poorly on them or their team.

If CS interviews a customer, they may soften their complaints or avoid mentioning sensitive issues, wanting to keep the relationship positive.

A Product Marketer often makes an ideal interviewer. They’re seen as a trusted, impartial voice: connected enough to understand the context, but not emotionally tied to whether the deal was a win or loss. This perspective encourages honest, candid responses and leads to richer insights.

Start Warm (Always)

Never dive straight into the decision. Instead, kick off the interview with a warm, simple question that helps the buyer feel comfortable and at ease:

“Can you walk me through how this project began?”

“Before we talk about vendors, can you tell me what problem you were trying to solve?”

“What was the moment when this became a priority?”

Starting with these warm, easy questions helps build rapport, relaxes the buyer, and gives you important context for everything that follows.

Keep Questions Open-Ended, Not Leading

It’s tempting to ask questions that steer the buyer toward certain answers, but this introduces bias and can distort the true story.

❌ Instead of: “Was the product too complex?”

✅ Ask: “What was your impression of the product?”

❌ Instead of: “Did price affect your decision?”

✅ Ask: “What factors mattered most when you compared options?”

Practice The 5 Why’s Approach

One common mistake interviewers make is stopping at the first vague or superficial answer.

When a buyer mentions something interesting or important, don’t just accept it at face value. Dig deeper.

Start by asking “why?” after their initial response. For example, if they say, “Price was a concern,” follow up with, “Why was price a concern?” If they answer, ask again, “Why does that matter?” Keep going — usually about 4-5 times — until you reach the real root cause.

This structure of starting broad and gradually narrowing will help guide the buyer through their story logically.

It also creates a natural storytelling arc. They’re sharing their experience in a way that’s intuitive and human. This makes interviews more engaging, genuine, and revealing.

If you’re following their journey in order, you can expect to uncover a wealth of insights, such as:

Early signals that sparked urgency or awareness

Key influencers and internal politics that shaped their choices

Hidden competitors or alternatives that influenced their thinking

Friction points in your sales process, demos, or evaluations

Moments of delight or disappointment that impacted their perception

Late-stage surprises that unexpectedly shifted the outcome

Running Great Interviews

Remember: a win-loss interview isn’t an interrogation. It’s a relaxed conversation where the buyer feels comfortable sharing the honest truth.

The quality of your interview depends less on what you ask, and far more on how you ask it. Your role is to create a space of curiosity, neutrality, and genuine interest.

Here’s how to run interviews that actually uncover what happened in the deal.

Use a Neutral Third-Party Interviewer When Possible

Buyers tend to speak more freely when they don’t think they’re talking to someone with an agenda.

If a salesperson or PM interviews a prospect, they may hold back critique fearing it could reflect poorly on them or their team.

If CS interviews a customer, they may soften their complaints or avoid mentioning sensitive issues, wanting to keep the relationship positive.

A Product Marketer often makes an ideal interviewer. They’re seen as a trusted, impartial voice: connected enough to understand the context, but not emotionally tied to whether the deal was a win or loss. This perspective encourages honest, candid responses and leads to richer insights.

Start Warm (Always)

Never dive straight into the decision. Instead, kick off the interview with a warm, simple question that helps the buyer feel comfortable and at ease:

“Can you walk me through how this project began?”

“Before we talk about vendors, can you tell me what problem you were trying to solve?”

“What was the moment when this became a priority?”

Starting with these warm, easy questions helps build rapport, relaxes the buyer, and gives you important context for everything that follows.

Keep Questions Open-Ended, Not Leading

It’s tempting to ask questions that steer the buyer toward certain answers, but this introduces bias and can distort the true story.

❌ Instead of: “Was the product too complex?”

✅ Ask: “What was your impression of the product?”

❌ Instead of: “Did price affect your decision?”

✅ Ask: “What factors mattered most when you compared options?”

Practice The 5 Why’s Approach

One common mistake interviewers make is stopping at the first vague or superficial answer.

When a buyer mentions something interesting or important, don’t just accept it at face value. Dig deeper.

Start by asking “why?” after their initial response. For example, if they say, “Price was a concern,” follow up with, “Why was price a concern?” If they answer, ask again, “Why does that matter?” Keep going — usually about 4-5 times — until you reach the real root cause.

Record, Transcribe, and Capture Verbatim Quotes

Memory can be tricky — it’s biased, and your notes will often miss important details or nuance. The simplest solution? Just record everything.

That way, you can:

Re-listen later for specific nuance

Tag quotes accurately later

Identify cross-interview patterns

Build credibility with stakeholders (“Here’s what the buyer actually said…”)

Plus, transcripts from recordings can be uploaded into tools like ChatGPT, Claude, or GoogleLM, enabling you to analyze multiple interviews quickly and extract shared insights.

Always Thank and Follow Up

If this step gets overlooked, it’s a huge missed opportunity. Remember, your buyer is doing you a favor by sharing their time and insights, so always show appreciation.

Send a warm thank-you note within 24 hours.

Acknowledge any honest or constructive feedback openly and respectfully.

Reassure them that their input is helping shape real change in your company.

A thoughtful follow-up isn’t just polite — it’s strategic. Today’s lost deal could be tomorrow’s win, and by demonstrating your gratitude you’re planting the seeds of a long-term relationship.

Record, Transcribe, and Capture Verbatim Quotes

Memory can be tricky — it’s biased, and your notes will often miss important details or nuance. The simplest solution? Just record everything.

That way, you can:

Re-listen later for specific nuance

Tag quotes accurately later

Identify cross-interview patterns

Build credibility with stakeholders (“Here’s what the buyer actually said…”)

Plus, transcripts from recordings can be uploaded into tools like ChatGPT, Claude, or GoogleLM, enabling you to analyze multiple interviews quickly and extract shared insights.

Always Thank and Follow Up

If this step gets overlooked, it’s a huge missed opportunity. Remember, your buyer is doing you a favor by sharing their time and insights, so always show appreciation.

Send a warm thank-you note within 24 hours.

Acknowledge any honest or constructive feedback openly and respectfully.

Reassure them that their input is helping shape real change in your company.

A thoughtful follow-up isn’t just polite — it’s strategic. Today’s lost deal could be tomorrow’s win, and by demonstrating your gratitude you’re planting the seeds of a long-term relationship.

Record, Transcribe, and Capture Verbatim Quotes

Memory can be tricky — it’s biased, and your notes will often miss important details or nuance. The simplest solution? Just record everything.

That way, you can:

Re-listen later for specific nuance

Tag quotes accurately later

Identify cross-interview patterns

Build credibility with stakeholders (“Here’s what the buyer actually said…”)

Plus, transcripts from recordings can be uploaded into tools like ChatGPT, Claude, or GoogleLM, enabling you to analyze multiple interviews quickly and extract shared insights.

Always Thank and Follow Up

If this step gets overlooked, it’s a huge missed opportunity. Remember, your buyer is doing you a favor by sharing their time and insights, so always show appreciation.

Send a warm thank-you note within 24 hours.

Acknowledge any honest or constructive feedback openly and respectfully.

Reassure them that their input is helping shape real change in your company.

A thoughtful follow-up isn’t just polite — it’s strategic. Today’s lost deal could be tomorrow’s win, and by demonstrating your gratitude you’re planting the seeds of a long-term relationship.

Template: The Win-Loss Interview Guide

The Win-Loss Interview Guide Template includes a simple checklist for running great interviews.

Win-Loss Interview Guide Template

Template: The Win-Loss Interview Guide

The Win-Loss Interview Guide Template includes a simple checklist for running great interviews.

Win-Loss Interview Guide Template

Template: The Win-Loss Interview Guide

The Win-Loss Interview Guide Template includes a simple checklist for running great interviews.

Win-Loss Interview Guide Template

Analyzing Insights

You can run great interviews, but unless you know how to analyze them effectively, your win-loss program becomes another tedious task that delivers little value.

This is the crucial moment where raw transcripts transform into clear patterns. Where you earn credibility with leadership and generate insights that actually influence decisions.

Here’s how to transform your interview data into actionable company knowledge:

1. Return to Your Learning Objectives

Everything you do should tie back to the objectives you set at the start. Rather than scanning transcripts randomly for “interesting comments,” focus on evidence related directly to your key questions.

Create a dedicated section or notes area for each objective. Collect relevant quotes, examples, and evidence under these headings. This keeps your analysis focused, and turns a pile of transcripts into a targeted, strategic review.

2. Tag Themes Across Interviews

Once you’ve pulled insights tied to your learning objectives, you’ll still have tons of rich data left over — anecdotes, emotional cues, frustrations, praises, deal dynamics. To make sense of it, tag everything.

Common tags include:

Product: capabilities, UX, performance, gaps

Price: affordability, packaging, perceived value

Process: speed, responsiveness, demo quality, proposal steps

Competition: who showed up, how they positioned, why they won/lost

Relationship: trust, communication style, rep experience

Tagging helps surface trends that go beyond specific questions. For example, if three buyers independently describe your sales process as “slow,” that’s not an accident — that’s a pattern begging for attention.

3. Look for Patterns and Contradictions

Patterns reveal what’s happening repeatedly in your buyer journey. But there are also contradictions that highlight nuance and complexity. Both are gold.

Patterns sound like:

“Seven buyers mentioned confusing pricing.”

“Competitor X was praised for ease of use in four interviews.”

“Three losses cited late-stage blocker from IT.”

Contradictions sound like:

“One buyer found the product incredibly intuitive; another said it was overwhelming.”

“Some praised our responsiveness; others said it felt slow.”

Patterns guide confident recommendations, while contradictions help you avoid oversimplifications — and sometimes uncover segmentation differences you didn’t know existed.

4. Quantify Where Possible

Even though win-loss is primarily qualitative, adding light quantification makes your insights more persuasive. You don’t need statistical significance though, directional signals are typically enough.

For example:

60% of buyers referenced a feature gap

5 of 8 losses mentioned a competitor you didn’t expect

3 out of 4 said the demo was too technical

Half the wins cited strong rapport with your AE

Even small numbers can have big impact when they map to critical decisions. Whenever possible, pair your quantitative signal with a verbatim quote to add some emotional weight and credibility.

Analyzing Insights

You can run great interviews, but unless you know how to analyze them effectively, your win-loss program becomes another tedious task that delivers little value.

This is the crucial moment where raw transcripts transform into clear patterns. Where you earn credibility with leadership and generate insights that actually influence decisions.

Here’s how to transform your interview data into actionable company knowledge:

1. Return to Your Learning Objectives

Everything you do should tie back to the objectives you set at the start. Rather than scanning transcripts randomly for “interesting comments,” focus on evidence related directly to your key questions.

Create a dedicated section or notes area for each objective. Collect relevant quotes, examples, and evidence under these headings. This keeps your analysis focused, and turns a pile of transcripts into a targeted, strategic review.

2. Tag Themes Across Interviews

Once you’ve pulled insights tied to your learning objectives, you’ll still have tons of rich data left over — anecdotes, emotional cues, frustrations, praises, deal dynamics. To make sense of it, tag everything.

Common tags include:

Product: capabilities, UX, performance, gaps

Price: affordability, packaging, perceived value

Process: speed, responsiveness, demo quality, proposal steps

Competition: who showed up, how they positioned, why they won/lost

Relationship: trust, communication style, rep experience

Tagging helps surface trends that go beyond specific questions. For example, if three buyers independently describe your sales process as “slow,” that’s not an accident — that’s a pattern begging for attention.

3. Look for Patterns and Contradictions

Patterns reveal what’s happening repeatedly in your buyer journey. But there are also contradictions that highlight nuance and complexity. Both are gold.

Patterns sound like:

“Seven buyers mentioned confusing pricing.”

“Competitor X was praised for ease of use in four interviews.”

“Three losses cited late-stage blocker from IT.”

Contradictions sound like:

“One buyer found the product incredibly intuitive; another said it was overwhelming.”

“Some praised our responsiveness; others said it felt slow.”

Patterns guide confident recommendations, while contradictions help you avoid oversimplifications — and sometimes uncover segmentation differences you didn’t know existed.

4. Quantify Where Possible

Even though win-loss is primarily qualitative, adding light quantification makes your insights more persuasive. You don’t need statistical significance though, directional signals are typically enough.

For example:

60% of buyers referenced a feature gap

5 of 8 losses mentioned a competitor you didn’t expect

3 out of 4 said the demo was too technical

Half the wins cited strong rapport with your AE

Even small numbers can have big impact when they map to critical decisions. Whenever possible, pair your quantitative signal with a verbatim quote to add some emotional weight and credibility.

Analyzing Insights

You can run great interviews, but unless you know how to analyze them effectively, your win-loss program becomes another tedious task that delivers little value.

This is the crucial moment where raw transcripts transform into clear patterns. Where you earn credibility with leadership and generate insights that actually influence decisions.

Here’s how to transform your interview data into actionable company knowledge:

1. Return to Your Learning Objectives

Everything you do should tie back to the objectives you set at the start. Rather than scanning transcripts randomly for “interesting comments,” focus on evidence related directly to your key questions.

Create a dedicated section or notes area for each objective. Collect relevant quotes, examples, and evidence under these headings. This keeps your analysis focused, and turns a pile of transcripts into a targeted, strategic review.

2. Tag Themes Across Interviews

Once you’ve pulled insights tied to your learning objectives, you’ll still have tons of rich data left over — anecdotes, emotional cues, frustrations, praises, deal dynamics. To make sense of it, tag everything.

Common tags include:

Product: capabilities, UX, performance, gaps

Price: affordability, packaging, perceived value

Process: speed, responsiveness, demo quality, proposal steps

Competition: who showed up, how they positioned, why they won/lost

Relationship: trust, communication style, rep experience

Tagging helps surface trends that go beyond specific questions. For example, if three buyers independently describe your sales process as “slow,” that’s not an accident — that’s a pattern begging for attention.

3. Look for Patterns and Contradictions

Patterns reveal what’s happening repeatedly in your buyer journey. But there are also contradictions that highlight nuance and complexity. Both are gold.

Patterns sound like:

“Seven buyers mentioned confusing pricing.”

“Competitor X was praised for ease of use in four interviews.”

“Three losses cited late-stage blocker from IT.”

Contradictions sound like:

“One buyer found the product incredibly intuitive; another said it was overwhelming.”

“Some praised our responsiveness; others said it felt slow.”

Patterns guide confident recommendations, while contradictions help you avoid oversimplifications — and sometimes uncover segmentation differences you didn’t know existed.

4. Quantify Where Possible

Even though win-loss is primarily qualitative, adding light quantification makes your insights more persuasive. You don’t need statistical significance though, directional signals are typically enough.

For example:

60% of buyers referenced a feature gap

5 of 8 losses mentioned a competitor you didn’t expect

3 out of 4 said the demo was too technical

Half the wins cited strong rapport with your AE

Even small numbers can have big impact when they map to critical decisions. Whenever possible, pair your quantitative signal with a verbatim quote to add some emotional weight and credibility.

Turning Insights Into Action

This is where everything comes together. Where your interviews, research, and analysis turn into action for your company. The true value of win-loss isn’t in what you learn. It’s in what your company does because of it.

This is how you close the loop.

1. Tailor Outputs to Each Audience

Different teams care about different truths. Your job is to package insights so each audience sees themselves in the story — and knows exactly what to do next.

For Executives:

Focus on signal, not noise. Execs want clarity and direction without drowning in details. Keep it short and outcome-oriented.

Give them:

Key metrics (win rate shifts, competitive frequency, top decision drivers)

High-level deal patterns

Strategic implications for the roadmap, GTM, and revenue growth

2–3 recommended actions they can sponsor and champion

For Sales Teams:

Show them how to win more often. This isn’t about blaming reps, it’s about empowering them.

Focus on:

Objections patterns and recurring stall points

Why deals get stuck at certain stages

Competitor tactics that outmaneuver them

Best practices from top performers

Clear, practical enablement tips

For Product Teams:

Product cares about evidence, not opinions, that help influence the roadmap.

Share:

Repeated feature gaps and UX friction points

How buyers perceive your strengths vs. competitors

What “good enough” looks like from the customer’s perspective

Prioritized problem areas tied to real quotes and frequency

2. Deliver Quarterly Readouts (Your Win-Loss Briefings)

Treat win-loss insights as a regular, recurring input. Consistency builds trust, and organizations rely on your insights to guide decisions.

Set a predictable cadence:

Quarterly “Win-Loss Briefing” meetings

A single, well-structured deck

Summary page for each learning objective

Data + verbatim quotes + recommended actions

A short discussion on what changed since last quarter

3. Track Decisions Made From Insights (Show the ROI)

This is the stage where your program matures from “interesting research” to a strategic engine driving results.

Maintain a simple internal log of:

Decisions influenced by win-loss

Owners responsible for follow-through

Status updates

Measurable outcomes (e.g., win rate improvement, fewer late-stage losses, improved demo satisfaction)

Over time, this tracking creates a clear ROI narrative, showing exactly how the program drives revenue and product improvements.

You know you’ve built a high-impact program when you can say things like:

“This insight led to a messaging update that increased win rate by 8%,” or

“This recurring feature gap drove a roadmap investment that saved X customers,”

You can also use win-loss insights to validate and verify intelligence and insights coming in from other areas, like ad hoc sales feedback. You can say “I know that’s true because I’ve heard it in X win-loss calls”

Ryan shares a real story about the impact of Win-Loss insights and how they can be put into action to drive real change:

Turning Insights Into Action

This is where everything comes together. Where your interviews, research, and analysis turn into action for your company. The true value of win-loss isn’t in what you learn. It’s in what your company does because of it.

This is how you close the loop.

1. Tailor Outputs to Each Audience

Different teams care about different truths. Your job is to package insights so each audience sees themselves in the story — and knows exactly what to do next.

For Executives: